Daily Mail Front Page 31st of October 2024

The recent budget announcement includes a significant £40 billion tax increase, affecting Britain’s economic growth and triggering concerns about its impact on businesses and individuals.

The recent budget announcement includes a significant £40 billion tax increase, affecting Britain’s economic growth and triggering concerns about its impact on businesses and individuals.

The Chancellor has announced the Budget for 2024, indicating a significant increase in public borrowing by £32 billion per year and raising taxes to the highest level on record, alongside concerns from economists about the potential stagnation of economic growth due to downgraded forecasts.

Rachel Reeves has announced a £70 billion investment in public services, including a £40 billion tax increase to fund improvements in the NHS, schools, and infrastructure, while keeping income tax and fuel duty unchanged.

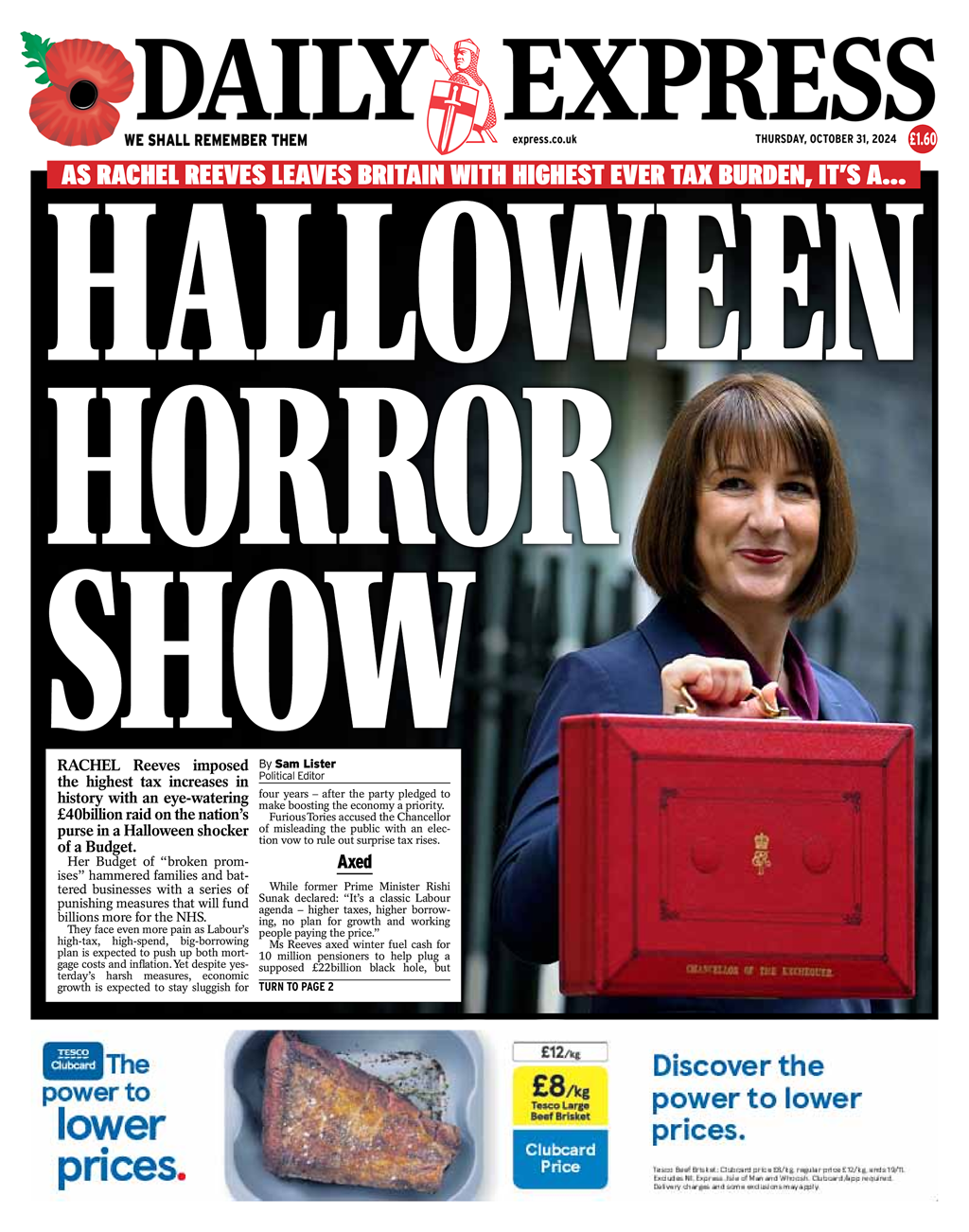

Rachel Reeves has introduced substantial tax increases, proposing a £40 billion budget aimed at addressing economic challenges and boosting funding for the NHS, while facing criticism for the potential impact on families and businesses.

The government has announced a budget that increases spending by £7 billion per year over the next five years, including tax hikes intended to address public finance challenges while boosting investment in the NHS and schools.

A proposed £40 billion tax initiative by the Chancellor is projected to stagnate wages and reduce living standards, potentially causing concern among millions of households and businesses.

Reports indicate a decline in ghost sightings, with experts noting a decrease in the frequency of such events.

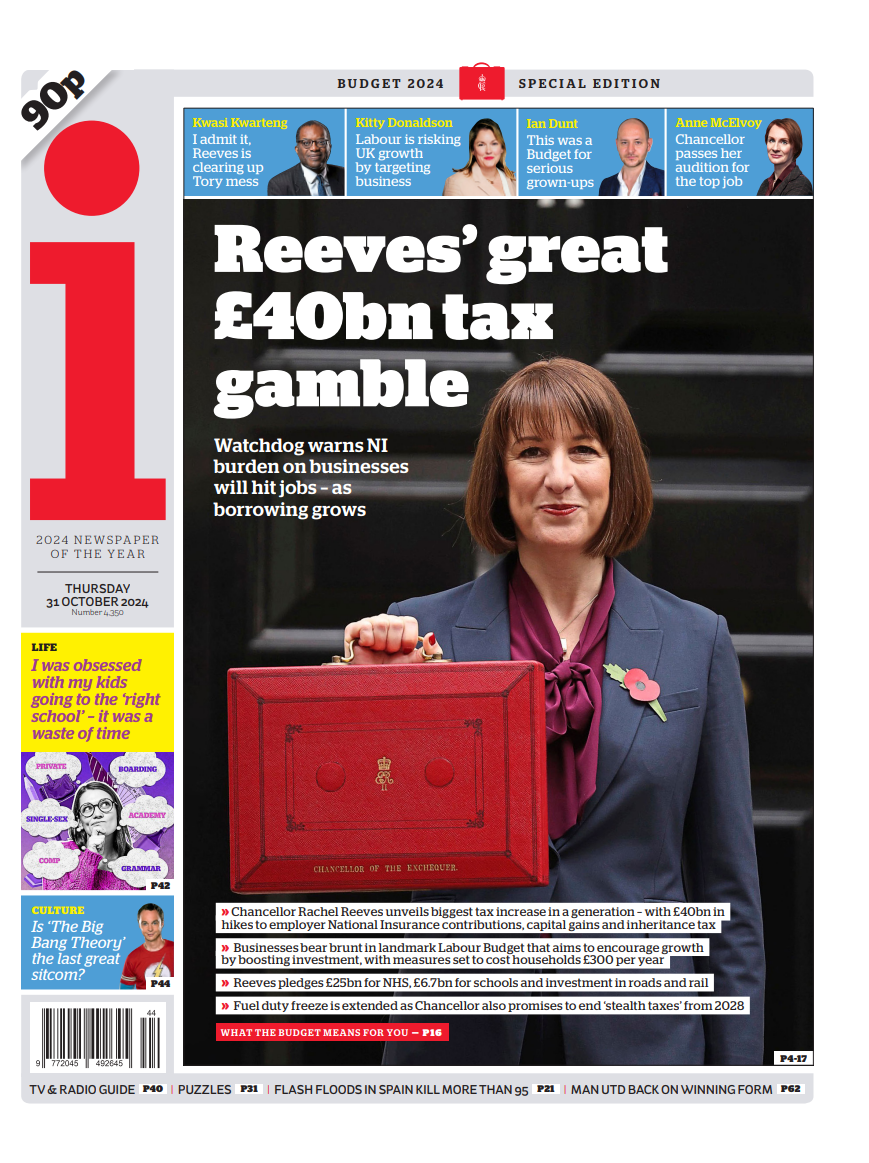

Chancellor Rachel Reeves has announced a substantial £40 billion tax increase aimed at boosting investment and growth, with measures affecting National Insurance contributions, capital gains, and inheritance tax, while also promising future investment in healthcare, education, and infrastructure.

The UK government has announced a budget with a £40 billion increase in taxes and borrowing, aimed at funding significant investments in public services such as the NHS and schools.

The Chancellor has introduced a £40 billion increase in taxes to address financial challenges and public service issues, with the majority of the fiscal responsibility falling on businesses and the wealthy, while also significantly increasing borrowing to fund £100 billion in capital expenditure.